Acquisition Summary:

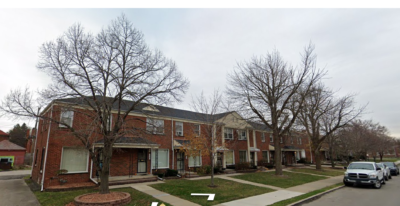

- Property Detail: 2 buildings, 14 units

- Acquisition Date: August 27, 2024

- Total Acquisition Price: $364,000

- Capital Expenditures (CapEx): $30,000 per door

- Potential Rent: $900 per door

- After Repair Value (ARV): To Be Created

This is Michiko from Mutual Trust Management Advisors LP.

Today, I want to show you what sets this Fund apart from other residential real estate funds, and how we really unlock value through our strategic acquisitions.

Many funds rely heavily on make-shift relationships with local partners for acquisitions and property management. In contrast, at Mutual Trust Management Advisors LP, one of the managers literally doubles as that local property management partner, eliminating unnecessary layers and ensuring control from start to finish.

Managing Risks

As Donald Rumsfeld noted, known unknowns are challenges we can anticipate. Investing always involves some uncertainty, but with the right team, opportunities with ‘known unknowns’ can offer attractive, risk-adjusted returns.

In this acquisition, we were asked to make an “as-is, all-cash” offer and a closing within weeks. The out-of-state seller had lost track of the tenants and could not provide valid leases or rent rolls, preventing our team from inspecting the occupied units. We did inspect the common areas and vacant units, ensuring that the major components such as the roof and boilers were in good shape.

Mousa, one of our managing members and head of Detroit’s largest property management operation, made the executive call, confident that his property management team could handle the situation with their extensive experience.

The Team acquired the two buildings at approximately $26,000 per door.

Given the unknown condition of the occupied units, we took an extremely conservative underwriting approach, budgeting $30,000 per unit for renovations.

Original Assumptions in Underwriting

Below are the original assumptions.

| total units | purchase price per unit | repair estimate per unit | total expenditures | |

| building 1 | 6 | $26,000.00 | $30,000.00 | $336,000.00 |

| building 2 | 8 | $26,000.00 | $30,000.00 | $448,000.00 |

| Total Budget | 14 | $364,000.00 | $420,000.00 | $784,000.00 |

After stabilization, we expect a cap rate of about 11% against the total price going in. Our actual underwriting simulation is a bit more complicated, since, in there, we factor in the holding costs and the cost of money, but here I would like to give you a simplified version.

| at $900 rent per unit/mo. | $12,600 |

| 5% vacancy | -630 |

| utilities | -150 |

| property tax | -2,647 |

| 8% management | -$958 |

| insurance | -204 |

| ongoing capex at 1% | -784 |

| net monthly cash flow | $7,227 |

| cap rate against $784,000 | 11.06% |

We expect evictions in many, if not in most of the occupied units. We are already at the end of August, so property management has to move fast, otherwise, winter is coming.

The properties are situated in a quiet area, primarily among similar brick apartments, so going in, the Team does not expect the real estate prices within this zip code to outperform. However, this street was very well known to our property manager, who vouched for the rental prospects with confidence.

The play is to make this a “cash cow” that allows the Fund to easily pay our investors their preferred returns.

We knew the likely risks and trusted that our team’s experience would see us through. Many other investors — fund or no fund —would not be able to take on the same risks. We pride ourselves on The MTMA Difference. Are we right?

You are about to find out!