At Mutual Trust Management Advisors, our investment strategy is focused on acquiring and operating scattered-site single-family rental homes in working-class neighborhoods. As national rent growth softens and institutional multifamily markets face mixed performance, Detroit stands out as one of the most resilient markets for single-family rental properties in the United States.

Single-Family Rentals: Detroit Leading the Pack

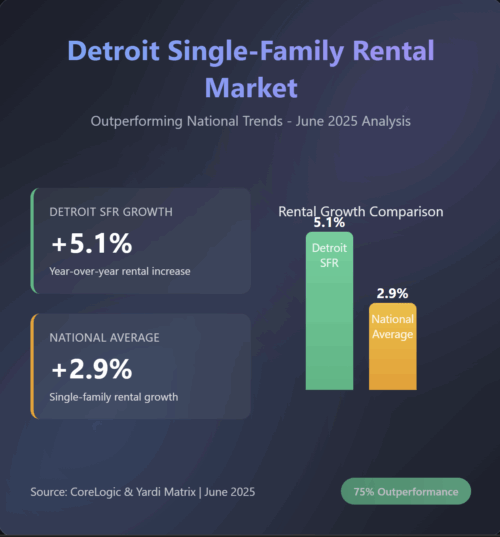

According to the CoreLogic Single-Family Rent Index, published by Multi-Housing News, national rent growth for single-family homes was 2.9 percent year-over-year as of June 2025. Detroit outperformed significantly, recording a 5.1 percent year-over-year increase. This places Detroit among the top-performing metropolitan areas for single-family rental growth.

The CoreLogic index is based on repeat lease transactions and tracks new-tenant pricing, making it one of the most responsive indicators of real-time rental market performance. The index focuses on single-family properties, including detached homes and townhomes, across both institutional portfolios and smaller investor holdings.

Key Drivers of Detroit’s Outperformance in Single-Family Rentals:

Detroit remains significantly more affordable than many of its nearby sisters, attracting renters priced out of suburban markets. New supply of single-family rental homes remains limited in these neighborhoods. Institutional build-to-rent developers tend to avoid the area due to the lack of scale and lower projected margins. Retail homebuyers also do not build in these areas, as the low price points and income levels make new construction financially unviable. As a result, this supply-constrained environment is likely to persist, possibly supporting a stable renter base for the foreseeable future.

For owners of scattered-site portfolios like ours, this is a validation of our long-term thesis: local market expertise, disciplined acquisition, and a focus on renter-by-necessity tenants can produce durable returns even as national conditions fluctuate.

Additional Note on the Multifamily Market: Detroit Continues to Outperform

While our fund does not focus on apartment complexes, we are a mixed-portfolio fund. Let us take a look at the multifamily data from the June 2025 Yardi Matrix report which can offer further useful context.

Nationwide, multifamily rent growth has slowed to just 0.9 percent year-over-year. In comparison, Detroit posted a 2.9 percent increase, again ranking among the top five cities tracked. Detroit’s low new supply pipeline—just 0.8 percent of total stock added in the last 12 months—has again helped sustain pricing even as other markets experience overbuilding and softening demand.

In contrast, previously high-profiled Sun Belt markets such as Austin, Phoenix, and Denver have experienced year-over-year rent declines of 2 to 5 percent due to excess supply and weakening absorption.

Strategic Implications for Our Fund

These combined data points reinforce the positioning of our fund:

-

Detroit offers one of the strongest combinations of affordability, stable occupancy, and rising demand in both the single-family and multifamily rental sectors

-

Scattered-site single-family rentals continue to deliver attractive income yields, supported by consistent tenant demand

-

Demand from renters-by-necessity remains elevated, while new supply is constrained

-

National affordability pressures continue to push renters toward stable, lower-cost markets like Detroit

We are pleased to confirm that Detroit remains a fundamentally sound and attractive market for disciplined and experienced ground operators as of July 2025. We will continue to monitor both the single-family and multifamily sectors as part of our macro risk and rent growth modeling, and update our investors in a timely manner.

Sources:

CoreLogic Single-Family Rent Index, via Multi-Housing News

Yardi Matrix Multifamily National Report – June 2025