Investment Summary on the 29 Pack Mostly-Rented Portfolio Purchase

The acquisition team was able to locate and negotiate an extremely favorable opportunity in this 29 Pack.

The thought process is that while picking up value-add SFRs one by one is a profitable model we have perfected, it typically takes up to nine months before a property is cash-flowing. That time lag has a cost. When we can vet every home in a discounted rental portfolio to our satisfaction, we can apply our other model—purchasing rented properties—and have them perform right away.

Our value-add property purchases typically need about $100,000 until stabilization in order to achieve top rent of $1,200.

In contrast, this pre-existing portfolio was quite attractive at $52,000 a door, because of the below components

- mostly in areas we focus

- priced at $52,000 a door; less serious capital expenditure to follow

- mostly rented at $720 a door; possible rental raise in play immediately after the closing

Out of the 29, only three properties, (5203 Beaconsfield, 11123 Wayburn, 13636 Pinewood) were vacant.

All the properties were given a visit that included a full inspection and renter interview followed by a repair estimate. Many of the rented properties were basically underwritten for $5,000 capital expenditure per property. Some, including a few that are rented, needed more work, bringing the average capital expenditure per unit to $10,000.

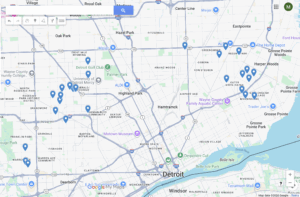

Portfolio Distribution Across Detroit: Courtesy Google Maps

| # | Property Address | Closing |

|---|---|---|

| 1 | 15757 Pinehurst Street, Detroit, MI 48238 | 2025-07-28 |

| 2 | 15871 Ward Avenue, Detroit, MI 48227 | 2025-07-28 |

| 3 | 8051 Westwood Street, Detroit, MI 48228 | 2025-07-28 |

| 4 | 17330 Greenlawn Street, Detroit, MI 48221 | 2025-07-28 |

| 5 | 19134 Greenlawn Street, Detroit, MI 48221 | 2025-07-28 |

| 6 | 6260 Piedmont Street, Detroit, MI 48228 | 2025-07-28 |

| 7 | 15757 Monte Vista Street, Detroit, MI 48238 | 2025-07-28 |

| 8 | 20410 Packard Street, Detroit, MI 48234 | 2025-07-28 |

| 9 | 13636 Pinewood Street, Detroit, MI 48205 | 2025-07-28 |

| 10 | 15758 Ardmore Street, Detroit, MI 48227 | 2025-07-28 |

| 11 | 4660 Devonshire Road, Detroit, MI 48224 | 2025-07-28 |

| 12 | 6444 Westwood Street, Detroit, MI 48228 | 2025-07-28 |

| 13 | 6451 Westwood Street, Detroit, MI 48228 | 2025-07-28 |

| 14 | 5203 Beaconsfield Street, Detroit, MI 48224 | 2025-07-28 |

| 15 | 5916 Lakepointe Street, Detroit, MI 48224 | 2025-07-28 |

| 16 | 10029 McKinney Street, Detroit, MI 48224 | 2025-08-15 |

| 17 | 10649 Meuse Street, Detroit, MI 48224 | 2025-08-15 |

| 18 | 15084 Whitcomb, Detroit, MI 48227 | 2025-08-15 |

| 19 | 15736 Appoline Street, Detroit, MI 48227 | 2025-08-15 |

| 20 | 14538 Strathmoor Street, Detroit, MI 48227 | 2025-08-15 |

| 21 | 13658 Capitol Street, Detroit, MI 48227 | 2025-08-15 |

| 22 | 14974 Mark Twain Street, Detroit, MI 48227 | 2025-08-15 |

| 23 | 13313 Robson Street, Detroit, MI 48227 | 2025-08-15 |

| 24 | 14190 Bringard Drive, Detroit, MI 48205 | 2025-08-15 |

| 25 | 11123 Wayburn Street, Detroit, MI 48224 | 2025-08-15 |

| 26 | 11459 Lakepointe Street, Detroit, MI 48224 | 2025-08-15 |

| 27 | 15667 Manning Street, Detroit, MI 48205 | 2025-08-15 |

| 28 | 13418 Kilbourne Street, Detroit, MI 48213 | 2025-08-15 |

| 29 | 13530 Cloverlawn Avenue, Detroit, MI 48238 | 2025-08-15 |

For detailed analysis, see the below PDF.

The analysis below will be based off of the above summary.

Income Analysis – A COC of 7% Against Total Acquisition Cost

The portfolio was bringing in an estimated $18,730/month at an assumed 100% collection rate.

A good rule of thumb for total costs (excluding financing) in a big portfolio is to estimate that 40% of gross rent will go to operating expenses.

This is rough math, but a conservative starting point for large acquisitions because a perfect rent roll is not always available. Using a 40% expense load typically covers property management, property taxes, vacancies, collection issues, and routine maintenance.

That rough math would net this portfolio an annualized income as below:

$18,730 × 60% × 12 months = $134,856

We further factored in the estimated capital expenditures which was the fruit of the hard working acquisitions team and therefore likely to be very exacting, as well as extremely conservative:

Total expected CapEx: $320,000

Including closing costs and the CapEx reserve, the total acquisition cost for this portfolio was expected to be about $1,878,000. Again, this is conservative rough math intended to cover a range of scenarios.

Net annual income estimate of $134,856 ÷ total acquisition cost of $1,878,000 = 7.18% COC.

Based on the fact that our individually sourced SFRs—whether vacant value-adds or already rented with light repair—typically net 7–10%, we considered these cash-flow prospects attractive, particularly because this portfolio requires no downtime before cash flowing.

It is of some interest that a typical commercial income-approach appraisal in this context would use an 8% cap rate. That would imply a value of $1,685,700 (before closing costs and CapEx).

This confirms that our entry price captured a meaningful spread between ~$1.68M implied value and the $1.50M purchase price.

The team also believed the income potential to be higher, because many in-place rents were outdated and likely to be raised immediately post-closing. This follows the playbook from our recent rented SFR acquisitions, where the vetting as well as rent conversations with tenants occur prior to purchase decisions.

The careful door-to-door inspections led by Managing Partner Mousa Ahmad proved invaluable yet again.

Comparable Analysis – An Estimated Value of $2,000,000 to Unlock

Individual properties were assigned valuations using our own realtor comparables and Zillow. I will keep this section brief here and cover each address in follow-up posts.

If we were listing a fully vacated house under our control, we would place greater weight on our realtor comps. However, even with full-house inspections, as-is conditions can be harder to price precisely, so we first established our internal comp and then adopted Zillow’s number when it was lower than ours to remain deliberately conservative.

We are confident the aggregate value of the 29 properties exceeds $2,000,000. For certain outliers—such as 13313 Robson St, Detroit, MI 48227—we retained an extremely low placeholder that Zillow showed (about $9,600) when its algorithm did not generate a valid estimate. Pricing a functional, rented brick house at $9,600 is of course ridiculous, but we kept these unrealistic numbers to avoid overstating overall value.

The seller was in distress due to organizational disarray and needed to liquidate better-performing portfolios first. We moved quickly to secure the opportunity.

Reconciliation of Value – 10 to 30% Immediate Value Unlocking

Based on both the income approach and the comparable approach, we believe that we have created between 10 percent and 30 percent in value simply by purchasing these properties at the prices that we were able to negotiate.

Early Results Confirming the Value-Add Thesis

By the end of August, many rents had already been revised to the higher figures shown in the PDF.

Some properties, such as 5203 Beaconsfield, are being prepped for rent, so the dust still needs to settle. If we can increase the portfolio’s gross income by $9,000 per month as indicated, performance should rise above 10 percent.

When we earmark capital expenditure on a rented property, portions of that reserve are sometimes not utilized in the first year. For example, we may set aside a kitchen update that could be completed with the tenant in place, but the tenant may decline due to inconvenience.

This outcome is acceptable because on rare occasions we must overextend elsewhere. We prefer to overestimate the overall budget rather than underestimate it.

This early progress supports the original thesis for the 29-pack: immediate cash flow with conservative cushions, plus rent-driven upside. The real value that we gained is likely to be much higher than an initial 17%, or, 10% of value-add and 7% cash-on-cash during the first year.

For now, we will continue solemnly executing the plan address by address and report results as they post. We look forward to holding these properties long term for the real value to unveil as appropriate.